What is E-Invoicing Under GST? A Complete Guide for Indian Businesses

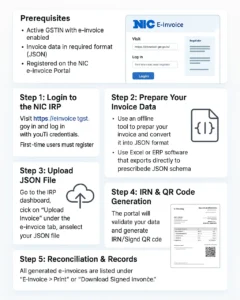

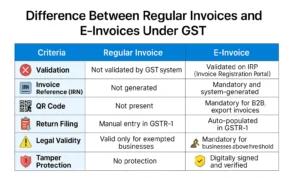

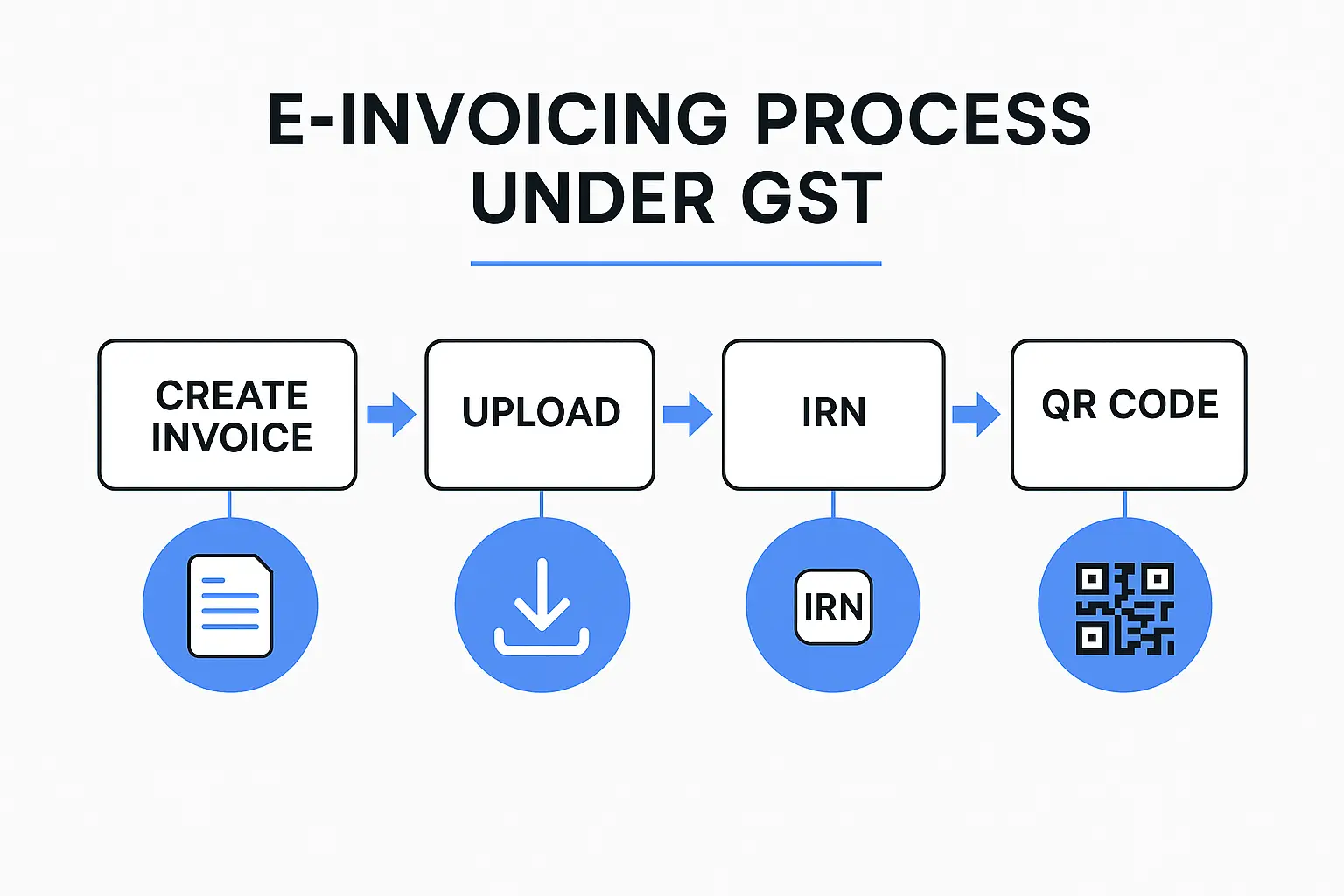

GST e-invoicing is a system where businesses report B2B invoices electronically to the Invoice Registration Portal (IRP). Once submitted, the IRP validates the invoice and assigns a unique Invoice Reference Number (IRN) and a digitally signed QR code.

Why Was E-Invoicing Introduced?

- To reduce invoice fraud and tax evasion

- To standardize invoice reporting across systems

- To ensure faster GST reconciliation and return filing

- To improve digital record-keeping and audits

Is E-Invoicing Mandatory for My Business?

Yes, if your business has an aggregate turnover of ₹5 crore or more in any financial year from 2017-18 onwards, e-invoicing is mandatory as of August 2023.

According to the GST Council, this threshold may soon be reduced to ₹1 crore. If that happens, lakhs of micro and small enterprises will need to comply.

What Are IRN and QR Code?

- IRN (Invoice Reference Number): A 64-character hash assigned by the IRP. It uniquely identifies your invoice.

- QR Code: This code contains essential invoice details like GSTIN, invoice number, date, amount, and IRN. It must be printed on every e-invoice.

Benefits of GST E-Invoicing

- Auto-population of GSTR-1 returns

- Fewer errors in invoice data and GST filing

- Improved buyer trust and payment tracking

- Digital audit trail for all B2B sales

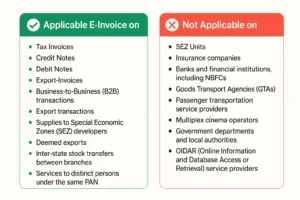

What Types of Invoices Require E-Invoicing?

E-invoicing applies to the following B2B transactions:

- Regular Tax Invoices (Sales)

- Credit Notes and Debit Notes

- Export Invoices

- Invoices to SEZ Units

Exceptions to E-Invoicing

The following businesses are exempt from e-invoicing, even if their turnover is above the threshold:

- SEZ developers (not units)

- Insurers, Banks, NBFCs

- Goods transport agencies (GTA)

- Cinemas, telecom service providers

Conclusion

E-invoicing under GST is here to stay and is expanding its reach. If your business meets the criteria, it’s critical to prepare your systems, staff, and processes accordingly to ensure timely compliance.

💡 Looking for a Simple Way to Start E-Invoicing?

BizBharat E-Invoice is a secure, Excel-based solution made for Indian MSMEs. No cloud, no APIs, no stress. Just copy your data and generate unlimited e-invoices with IRN + QR in seconds.

👉 Try BizBharat Now and prepare your business for GST compliance before the ₹1 Cr limit hits.

Frequently Asked Questions (FAQ’s)

No. As of 2025, it is mandatory only for businesses with annual turnover over ₹5 crore. However, the limit may reduce soon.

The invoice will be considered invalid for GST. Penalties may apply under Section 122 of the CGST Act.

Yes, but you must convert it into the GST JSON schema and upload to IRP. It’s easier with compatible tools.

No. E-invoicing is applicable only for B2B and export invoices.