Latest E-Invoicing Rules and Turnover Limits (Updated 2025)

India’s e-invoicing system under GST continues to expand, bringing more businesses under its compliance umbrella. Whether you’re a trader, manufacturer, exporter, or small business owner, understanding the current turnover thresholds and new rules is crucial for avoiding penalties and ensuring seamless operations in 2025.

📢 What is E-Invoicing in GST?

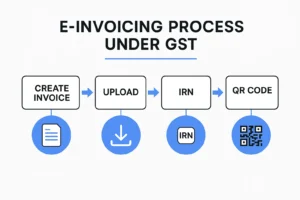

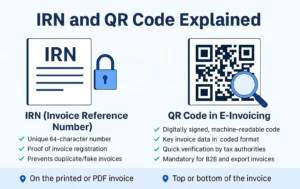

Under GST, certain businesses must generate invoices through the government’s Invoice Registration Portal (IRP). Each invoice is validated and assigned an Invoice Reference Number (IRN) and a QR code. This process makes the invoice legally valid and compliant.

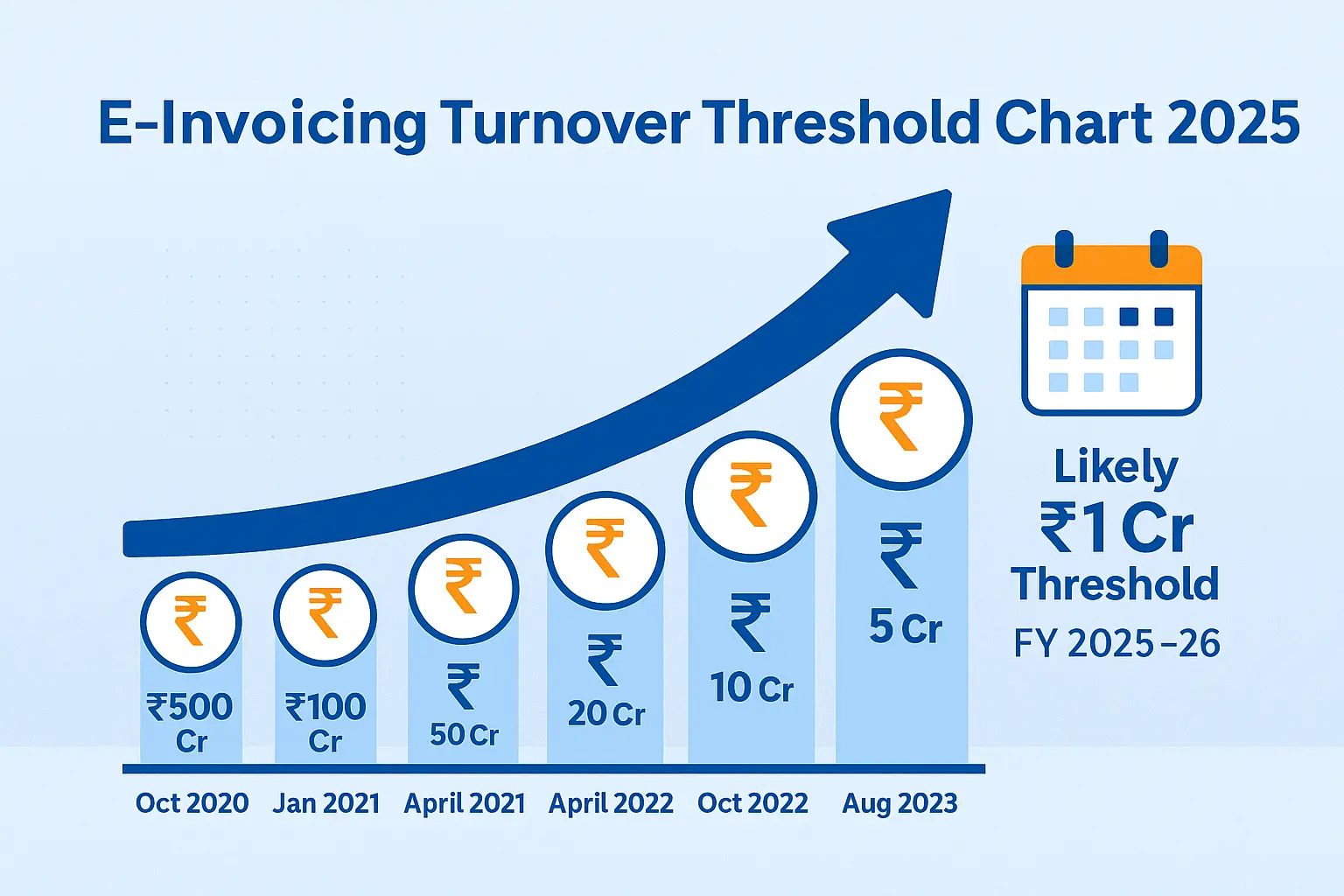

📊 Turnover-Based E-Invoicing Mandates (As of 2025)

The following turnover limits apply for mandatory e-invoicing, based on aggregate turnover in any financial year since 2017–18:

- ✅ ₹500 crore and above – Mandatory from October 1, 2020

- ✅ ₹100 crore and above – From January 1, 2021

- ✅ ₹50 crore and above – From April 1, 2021

- ✅ ₹20 crore and above – From April 1, 2022

- ✅ ₹10 crore and above – From October 1, 2022

- ✅ ₹5 crore and above – From August 1, 2023

🚨 Upcoming Rule: Likely ₹1 Crore Threshold

The GST Council is expected to reduce the e-invoicing threshold further to ₹1 crore in turnover during FY 2025–26. This move will impact lakhs of micro and small enterprises that currently use regular invoices.

Pro Tip: If your turnover is above ₹1 crore, it’s wise to start preparing now to avoid last-minute compliance pressure.

🕒 New 30-Day IRN Reporting Rule (Effective April 1, 2025)

Businesses with turnover of ₹10+ crore or more are now required to report invoices to the IRP within 30 days of invoice generation. Failure to do so will render the invoice invalid.

🚫 This rule will soon apply to ₹5 crore+ turnover businesses, based on future notifications.

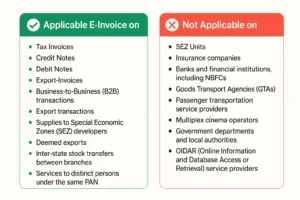

📂 Documents That Require E-Invoicing

- ➤ B2B Tax Invoices

- ➤ Export Invoices

- ➤ Credit Notes

- ➤ Debit Notes

📌 Key Benefits of E-Invoicing Compliance

- ✔ Auto-population of GSTR-1 and e-way bills

- ✔ Reduced chances of data mismatch

- ✔ Faster input tax credit (ITC) claim

- ✔ Stronger digital audit trail

🧾 Who is Exempt from E-Invoicing?

Entities exempt from e-invoicing include:

- ✖ Insurance companies

- ✖ Banks and NBFCs

- ✖ Goods Transport Agencies (GTAs)

- ✖ Passenger transport services

- ✖ SEZ units (SEZ developers are not exempt)

- ✖ Multiplex operators

- ✖ Government departments and local authorities

- ✖ OIDAR service providers

Conclusion

GST e-invoicing rules are evolving quickly. Staying updated with the latest turnover limits, reporting timelines, and exemptions ensures you avoid compliance risks. The sooner you adopt e-invoicing, the smoother your transition will be.

📌 Be Ready Before the ₹1 Crore Limit Hits

Millions of Indian businesses may soon be required to adopt e-invoicing. Don’t wait for the last-minute rush.

BizBharat E-Invoice is a secure, Excel-based solution that helps MSMEs generate unlimited e-invoices with IRN & QR code — 100% offline and API-free.

👉 Try BizBharat Now and stay ahead of compliance changes in 2025.

Frequently Asked Questions (FAQ’s)

₹5 crore and above. A new ₹1 crore threshold is expected soon.

From April 1, 2025, businesses with ₹10 Cr+ turnover must report invoices within 30 days of generation.

Yes. Aggregate turnover includes taxable, exempt, export, and inter-state supplies across all GSTINs under one PAN.

Yes. Voluntary compliance is allowed by registering on the IRP portal.