IRN and QR Code Explained: Everything You Need to Know

As e-invoicing becomes mandatory for more businesses in India, terms like IRN and QR Code are gaining importance. But what exactly do they mean? Why are they required? And how do you generate them?

In this guide, we’ll explain what IRN and QR codes are, how they are used in GST e-invoicing, and what every business owner must know to stay compliant in 2025.

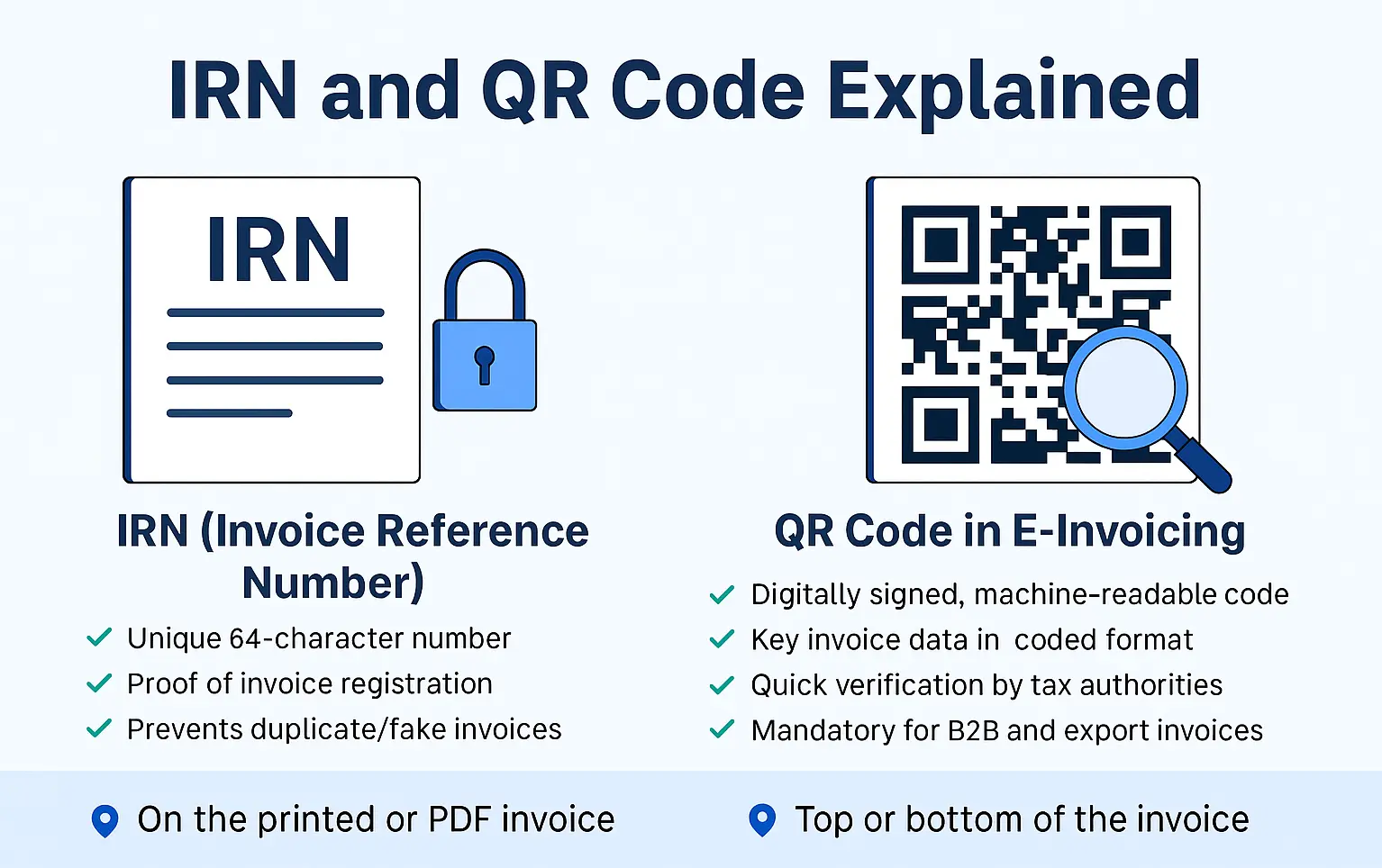

📌 What is IRN (Invoice Reference Number)?

The Invoice Reference Number (IRN) is a unique 64-character alphanumeric hash generated for each e-invoice. It is created by the GST system when your invoice is uploaded and successfully validated on the Invoice Registration Portal (IRP).

How is IRN Generated?

The IRN is generated using a hash algorithm applied to the supplier’s GSTIN, invoice number, and financial year. This ensures that each invoice is uniquely identifiable across the GST network.

Why is IRN Important?

- ✔ Acts as official proof of invoice registration

- ✔ Prevents duplication and fake invoices

- ✔ Must be included in every GST-compliant e-invoice

📷 What is the QR Code in E-Invoicing?

The QR Code is a digitally signed, machine-readable code generated by the IRP and included in the e-invoice. It contains essential invoice data and acts as a quick verification tool for tax officers and buyers.

What Data is Contained in the QR Code?

- ✔ Supplier GSTIN

- ✔ Recipient GSTIN

- ✔ Invoice number and date

- ✔ Invoice value and taxable amount

- ✔ HSN code and item details

- ✔ IRN (Invoice Reference Number)

Is the QR Code Mandatory?

Yes. If your business is subject to e-invoicing, all B2B and export invoices must carry the QR code generated from the IRP.

🧾 Where Should the IRN and QR Code Appear?

Once you receive the validated e-invoice from the IRP, the IRN and QR code should be included:

- 📌 On the top or bottom of the printed invoice

- 📌 In the PDF format shared with clients or uploaded to ERP

📥 How Do I Generate IRN and QR Code?

You can generate IRNs and QR codes using any of the following:

- ✔ Direct API integration (for large companies)

- ✔ Offline Excel/JSON-based tools (for MSMEs)

- ✔ GSP-supported billing software

🚫 Common Mistakes to Avoid

- ❌ Generating invoice without uploading to IRP

- ❌ Missing QR code in printed invoice

- ❌ Using old invoice formats not compatible with IRN schema

Conclusion

Understanding IRN and QR code is crucial for any business under the GST e-invoicing system. These identifiers ensure your invoices are valid, verifiable, and tax-compliant. Make sure your billing process includes proper IRP validation to avoid rejections or penalties.

🔍 Need Help Generating IRNs and QR Codes Easily?

BizBharat E-Invoice simplifies the process for MSMEs. Just enter your invoice details in Excel and generate valid IRNs + QR-coded e-invoices — all offline, no API needed.

Start using India’s most MSME-friendly e-invoicing software today.

👉 Try BizBharat Now and go GST-compliant the easy way.

Frequently Asked Questions (FAQ’s)

No. Such invoices will be considered invalid under GST law.

Yes. You must include it in the printed version or PDF shared with the recipient.

No. E-invoicing (and IRN) is required only for B2B and export invoices.

Yes, as long as the tool can create the correct JSON file to be uploaded to the IRP.