Step-by-Step Guide to Generate E-Invoices on the NIC Portal

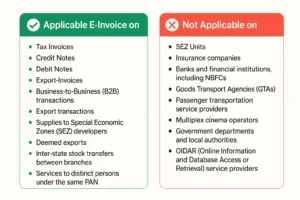

If your business turnover exceeds ₹5 crore, you are required to generate e-invoices through the Invoice Registration Portal (IRP), provided by the National Informatics Centre (NIC).

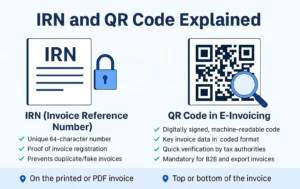

This guide walks you through each step to successfully create and upload an invoice on the NIC portal and generate a valid Invoice Reference Number (IRN) and QR code.

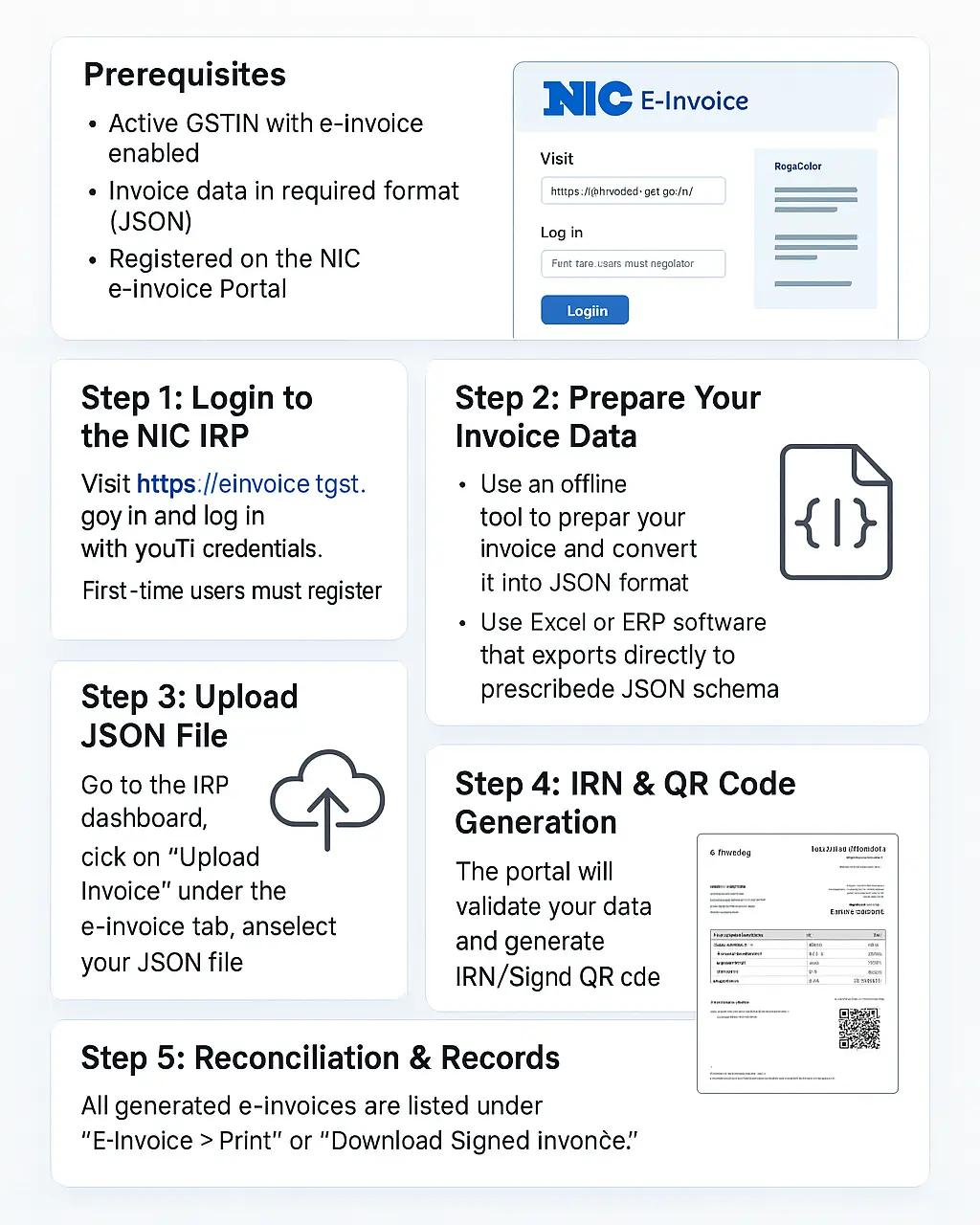

Prerequisites

- Active GSTIN with e-invoice enabled

- Invoice data in required format (JSON)

- Registered on the NIC e-Invoice Portal

Step 1: Login to the NIC IRP

Visit https://einvoice1.gst.gov.in/ and log in with your GSTIN credentials. First-time users must register.

Step 2: Prepare Your Invoice Data

You can either:

- Use an offline tool to prepare your invoice and convert it into JSON format

- Use Excel or ERP software that exports directly to the prescribed JSON schema

Ensure you include all mandatory fields like invoice number, date, GSTIN of buyer, HSN code, taxable value, tax amount, etc.

Step 3: Upload JSON File

Once your JSON file is ready, go to the IRP dashboard, click on “Upload Invoice” under the e-invoice tab, and select your JSON file.

Step 4: IRN & QR Code Generation

The portal will validate your data and generate:

- IRN (Invoice Reference Number)

- Signed QR code

You can now download or print your invoice with the embedded IRN and QR code.

Step 5: Reconciliation & Records

All generated e-invoices are listed under “E-Invoice > Print” or “Download Signed Invoice.” This helps you verify issued invoices before GSTR-1 filing.

Optional: Generate E-Way Bill Together

When uploading your invoice JSON, if you provide transport details (vehicle number, distance, etc.), you can simultaneously generate the e-way bill. This saves effort and ensures timely compliance.

Tips to Avoid Errors

- Double-check GSTINs of buyer/seller

- Validate item codes (HSN/SAC) and tax rates

- Make sure invoice date isn’t backdated beyond 30 days

- Use the latest offline tool version provided by NIC

Conclusion

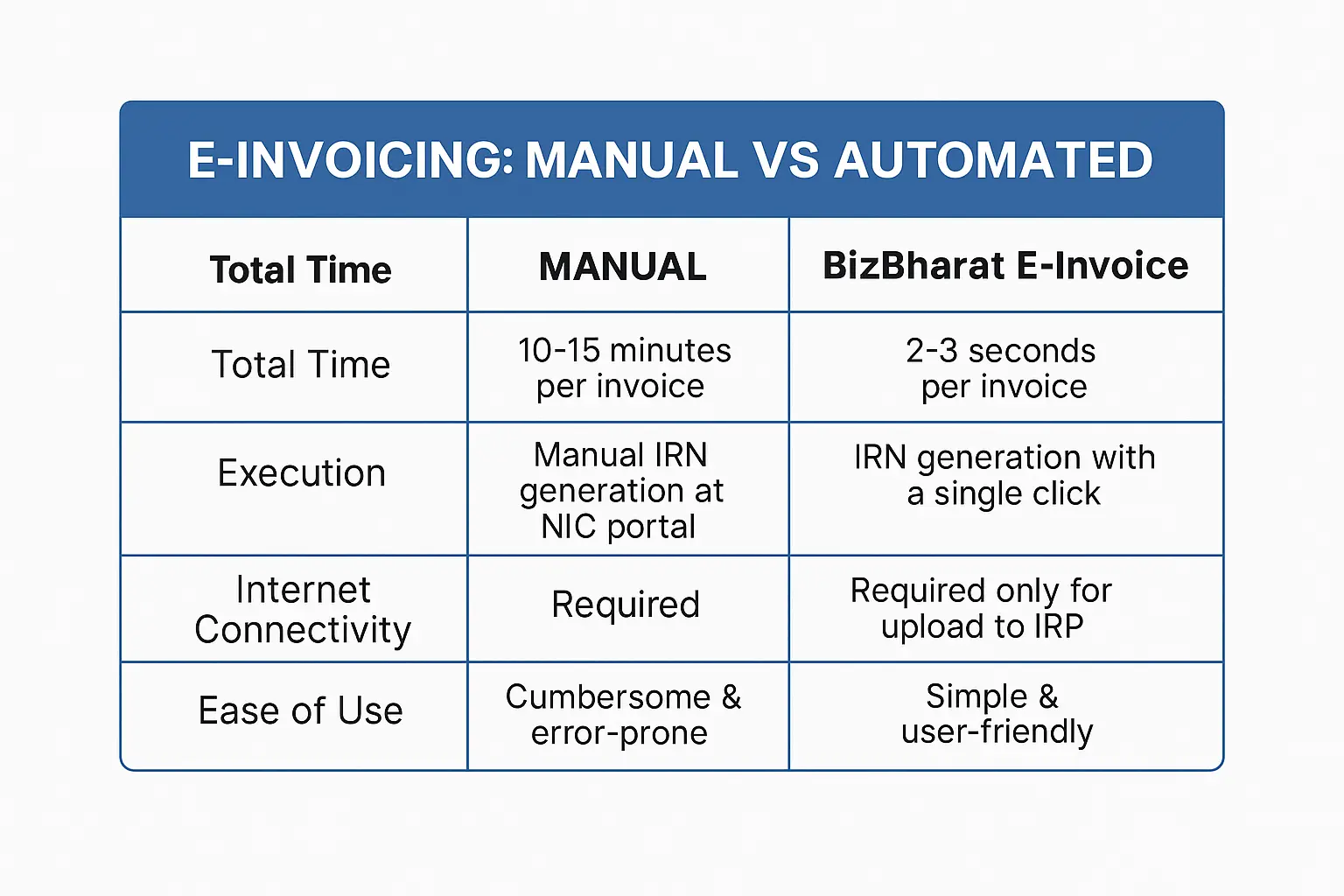

Manual IRN generation through the NIC portal can be tedious but is fully doable. MSMEs and mid-sized businesses should adopt proper invoice formatting and validation tools to avoid rejections and penalties.

✅ Looking for a Faster Way to Generate E-Invoices?

Using the NIC portal manually is doable — but time-consuming. If you’re tired of errors, rejections, or confusing JSON formats, switch to BizBharat E-Invoice.

It’s an Excel-based, 100% offline tool that helps Indian MSMEs generate unlimited IRNs and QR-coded invoices — without the need for APIs or internet. Fast, secure, and affordable.

👉 Try BizBharat Now and simplify your GST e-invoicing process today.

Frequently Asked Questions (FAQ’s)

Yes, you can use the NIC portal manually by uploading invoice JSONs created through offline tools.

Usually, the IRP generates the IRN and QR code within seconds after a successful JSON upload.

There’s no official daily cap, but bulk uploads are better managed through APIs or compatible software.

The IRP will reject it and show an error message. You must correct the data and re-upload.