E-Invoicing Applicability: Who Needs to Generate E-Invoices in 2025?

E-invoicing has become a core part of India’s GST compliance framework. If you’re wondering whether your business must generate e-invoices in 2025, this guide explains the latest applicability rules, turnover thresholds, and exceptions.

📌 What is E-Invoicing Applicability?

E-invoicing applicability refers to the rules that define which businesses are required to generate e-invoices under the Goods and Services Tax (GST) law. These rules are based primarily on a company’s annual turnover and the type of invoice issued.

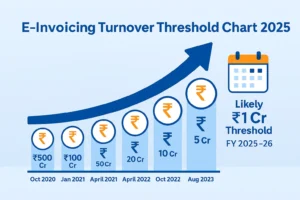

📊 Turnover-Based Applicability (As of 2025)

- ✅ Businesses with turnover of ₹500 Cr+ – Mandatory since Oct 2020

- ✅ ₹100 Cr+ – Mandatory since Jan 2021

- ✅ ₹50 Cr+ – Mandatory since April 2021

- ✅ ₹20 Cr+ – Mandatory since April 2022

- ✅ ₹10 Cr+ – Mandatory since Oct 2022

- ✅ ₹5 Cr+ – Mandatory since Aug 2023

- 🔜 Expected Soon: ₹1 Cr+ – Likely in FY 2025–26

These thresholds are based on the aggregate turnover in any financial year from 2017–18 onward.

⏰ New 30-Day E-Invoice Reporting Rule (Effective April 1, 2025)

From April 1, 2025, businesses with turnover of ₹10 Cr+ must upload their e-invoices to the Invoice Registration Portal (IRP) within 30 days of invoice issuance. This rule ensures timely reporting and prevents rejection of invoices generated after the allowed time window.

For example, if an invoice is dated 5th April 2025, it must be reported to IRP by 5th May 2025.

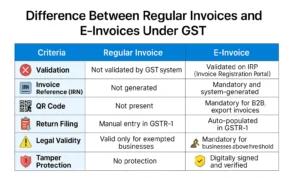

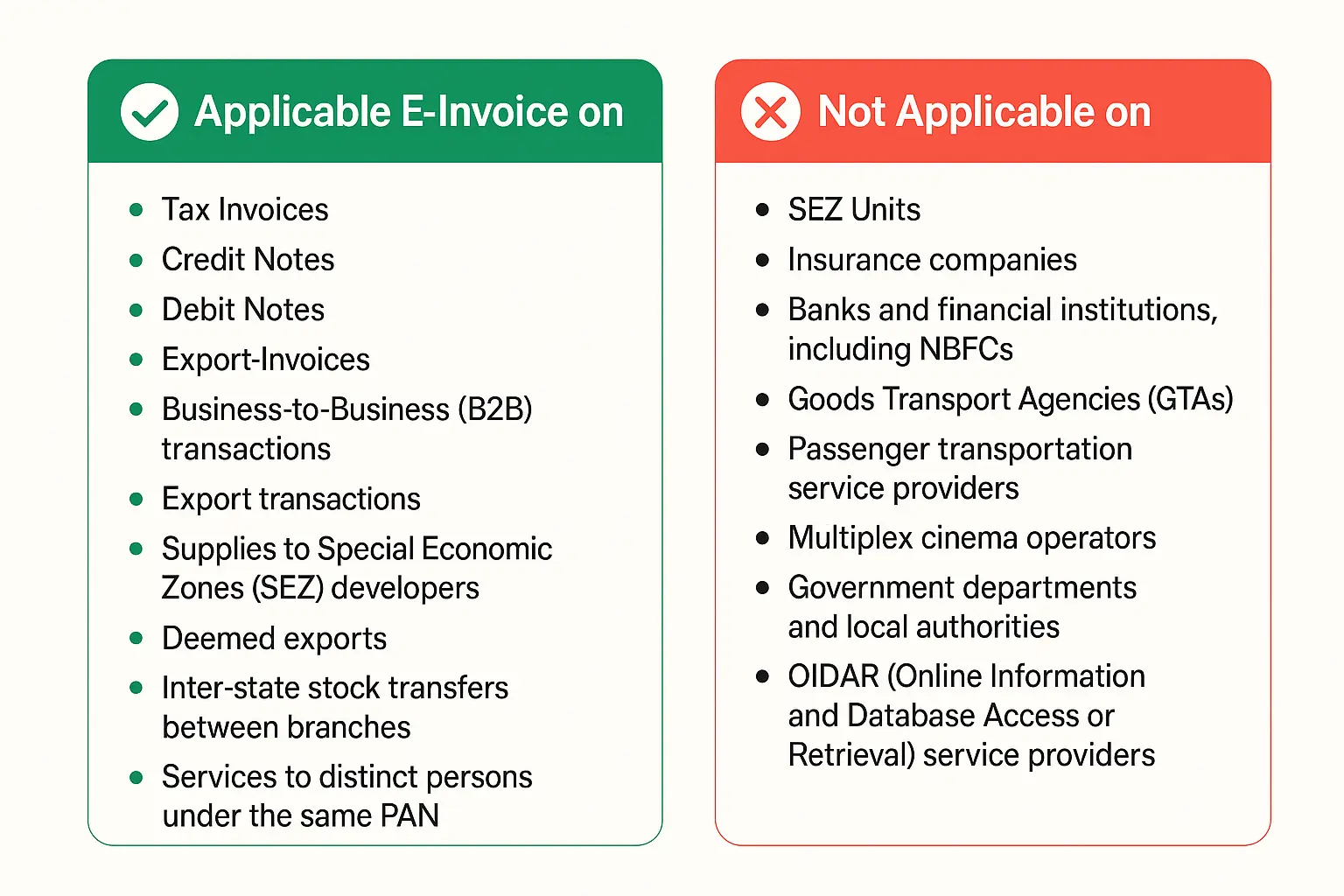

📂 Types of Invoices that Require E-Invoicing

If applicable, your business must generate e-invoices for the following documents:

- ➤ Tax Invoices

- ➤ Credit Notes

- ➤ Debit Notes

- ➤ Export Invoices

🧾 Transactions Requiring E-Invoicing

- ✔ Business-to-Business (B2B) transactions

- ✔ Business-to-Government (B2G) transactions

- ✔ Export transactions

- ✔ Supplies to Special Economic Zones (SEZ) developers

- ✔ Deemed exports

- ✔ Inter-state stock transfers between branches

- ✔ Services to distinct persons under the same PAN

- ✔ Reverse charge transactions as per Section 9(3) of CGST Act

🚫 Exempt Entities

The following entities are exempt from e-invoicing, regardless of turnover:

- ✖ SEZ Units (Note: SEZ Developers are not exempt)

- ✖ Insurance companies

- ✖ Banks and financial institutions, including NBFCs

- ✖ Goods Transport Agencies (GTAs)

- ✖ Passenger transportation service providers

- ✖ Multiplex cinema operators

- ✖ Government departments and local authorities

- ✖ OIDAR (Online Information and Database Access or Retrieval) service providers

💡 Pro Tip: Don’t Wait for the Last Minute

Many MSMEs with turnover between ₹1 Cr and ₹5 Cr may soon fall under mandatory e-invoicing. It’s advisable to prepare early and familiarize your team with the process.

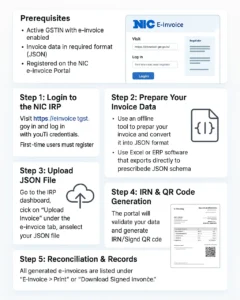

How to Check E-Invoicing Status?

You can verify if your GSTIN is currently live for e-invoicing on the official portal: Check your GSTIN here

Conclusion

E-invoicing applicability depends on your turnover and transaction type. If you fall within the threshold, it’s mandatory to comply or face invoice rejections, penalties, and GST return mismatches.

📌 Prepare for E-Invoicing Before It’s Mandatory

If your turnover is between ₹1–5 crore, don’t wait until the e-invoicing rule kicks in. Start early and streamline your GST compliance with BizBharat E-Invoice.

100% offline, Excel-based, and made for MSMEs. No cloud, no APIs — just quick, secure e-invoicing for Indian businesses.

👉 Try BizBharat Now and get future-ready.

Frequently Asked Questions (FAQ’s)

No. It’s only mandatory for businesses whose turnover exceeds the notified threshold.

Not yet. But if the threshold is reduced to ₹1 crore in 2025, you will likely fall under the mandate.

No, e-invoicing is not required for B2C or exempted entities like professionals, doctors, or lawyers.

Yes. It includes taxable, exempt, export, and inter-state supplies (across all GSTINs under the same PAN).

Businesses with aggregate turnover exceeding ₹10 crore in any financial year from 2017-18 onwards must report their e-invoices within 30 days of issuance on the IRP portal.