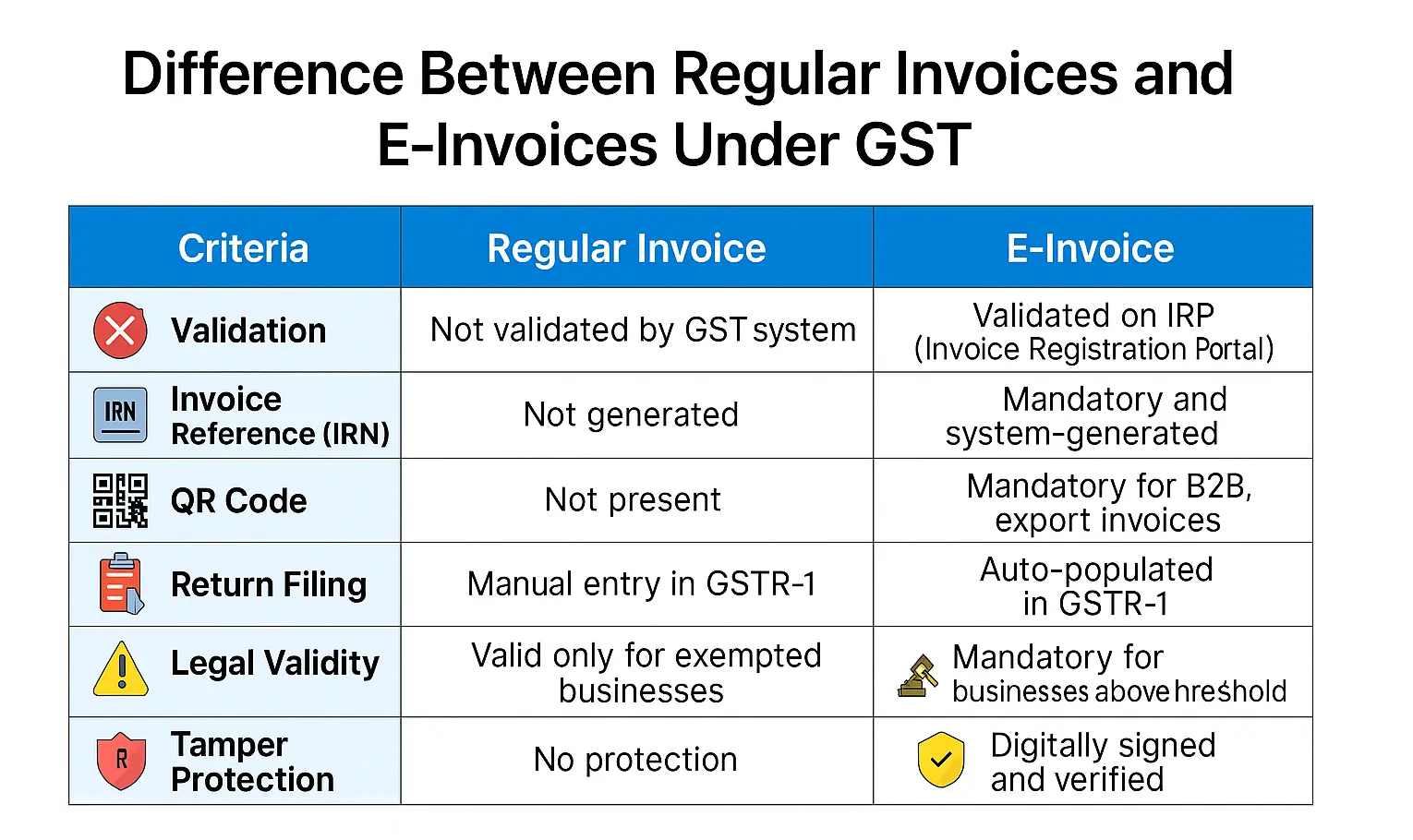

Difference Between Regular Invoices and E-Invoices Under GST

With the introduction of e-invoicing under GST, many businesses are confused about how e-invoices differ from regular invoices. While they may look similar at first glance, there are critical legal and technical differences you must understand — especially if your turnover crosses the government’s threshold.

📜 What is a Regular GST Invoice?

A regular invoice is the traditional invoice generated by a business using software like Tally, Busy, Excel, or manually. It contains details of the sale, tax, buyer, and seller but does not go through the government’s IRP (Invoice Registration Portal).

While regular invoices are valid for small businesses, they are not accepted as official GST invoices once a business crosses the e-invoicing applicability threshold.

💡 What is an E-Invoice?

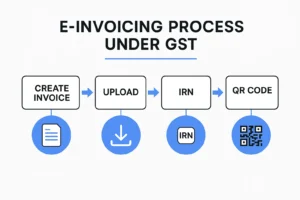

An e-invoice is a GST-compliant invoice that is uploaded to the IRP and validated by the GSTN. It receives a unique Invoice Reference Number (IRN) and a digitally signed QR code from the government portal.

This validation ensures the invoice is legally recognized, tamper-proof, and automatically integrated into the GST return system.

📊 Key Differences: Regular Invoice vs E-Invoice

🧾 Which One Do You Need?

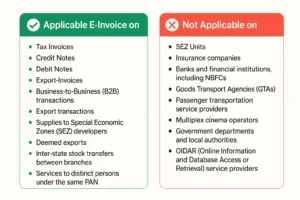

If your aggregate turnover is below ₹5 crore (as of 2025), you can still use regular invoices. But if you cross the threshold, you must generate e-invoices for B2B and export transactions to remain compliant.

🚨 Mistakes to Avoid

- ❌ Using regular invoices even after crossing the e-invoicing limit

- ❌ Failing to upload invoices to IRP before issuing them

- ❌ Missing QR codes and IRN on printed invoices

Conclusion

While both formats serve similar business purposes, e-invoices are a legal mandate with added layers of security and integration into the GST system. Businesses should prepare early and avoid non-compliance risks as turnover thresholds reduce over time.

✅ Ready to Switch from Regular to E-Invoices?

Don’t risk GST compliance issues. If your business is near the e-invoicing limit, prepare now with BizBharat E-Invoice.

Our Excel-based software helps you generate valid IRN + QR coded e-invoices without needing cloud access or APIs. It’s secure, offline, and built for Indian MSMEs.

👉 Try BizBharat Now – Start e-invoicing with ease and peace of mind.

Frequently Asked Questions (FAQ’s)

Yes, only if your turnover is below the mandatory threshold and you’re not subject to e-invoicing rules.

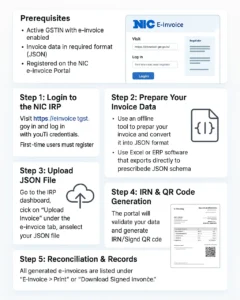

Yes, an e-invoice must be in JSON format for upload and must include IRN and QR code when printed.

Yes. If your business falls under e-invoicing and you fail to generate IRN, the invoice is invalid under GST law.

Yes, but only with compatible tools that export the data into the correct JSON format for IRP upload.